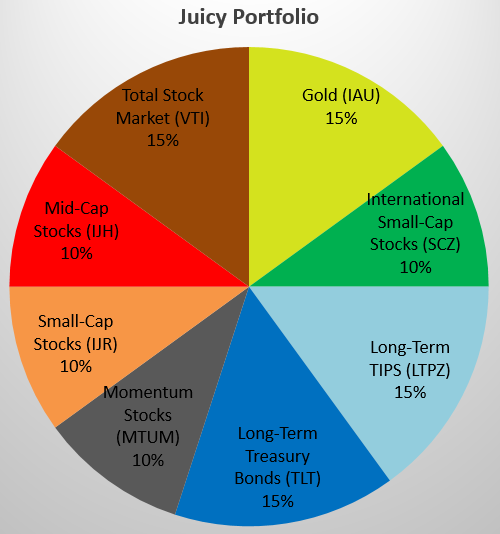

Low-cost index funds

| Exchange-traded fund (ETF) | Symbol | Percent of Portfolio | Expense Ratio | Morningstar Rating |

|---|---|---|---|---|

| iShares Gold Trust Gold |

IAU | 15% | 0.25% | N/A |

| iShares MSCI EAFE Small-Cap International Small-Cap, Developed Nations index |

SCZ | 10% | 0.40% | 4 star |

| iShares 20+ Year

U.S.Treasury Bond U.S. Long-term Treasury Bond index |

TLT | 15% | 0.15% | 4 star |

| PIMCO 15+

Year U.S. TIPS Bond U.S. Long-term TIPS Bond index |

LTPZ | 15% | 0.20% | 5 star |

| iShares

MSCI USA Momentum Factor U.S. Stock Market, stocks with momentum index |

MTUM | 10% | 0.15% | 3 star |

| iShares Core S&P Small-Cap Blend U.S. Stock Market, Small-Cap 600 index |

IJR | 10% | 0.06% | 5 star |

| iShares Core S&P Mid-Cap Blend U.S. Stock Market, Mid-Cap 400 index |

IJH | 10% | 0.05% | 5 star |

| Vanguard Total Stock Market U.S. Stock Market, Total index |

VTI | 15% | 0.03% | 4 star |

| Total weighted annual expense ratio | 0.16% | |||

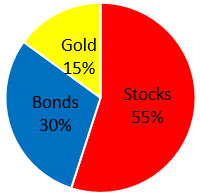

Overall asset class allocation

| Asset Class | Percent of Portfolio |

|

|---|---|---|

| Stocks | 55% | |

| Bonds | 30% | |

| Gold | 15% | |

| Cash | 0% |

Description

Inspired by the

Permanent Portfolio,

the Juicy Portfolio is a

passive portfolio

with

no cash. No market timing.

Buy and hold. Rebalance yearly. Its intended for USA investors. Since there's no cash in the portfolio, its

intended for those who already have an adequate cash emergency fund (12 months living

expenses).

The non-correlated asset classes (Stocks, Long-Term Bonds, Gold) are based on the

Permanent Portfolio concept and provide superior protection for all economic

conditions. In total, the 8 funds of the Juicy Portfolio create a

simple, diversified, all-weather investment approach.

Objective

Provide strong long-term capital appreciation with low volatility.

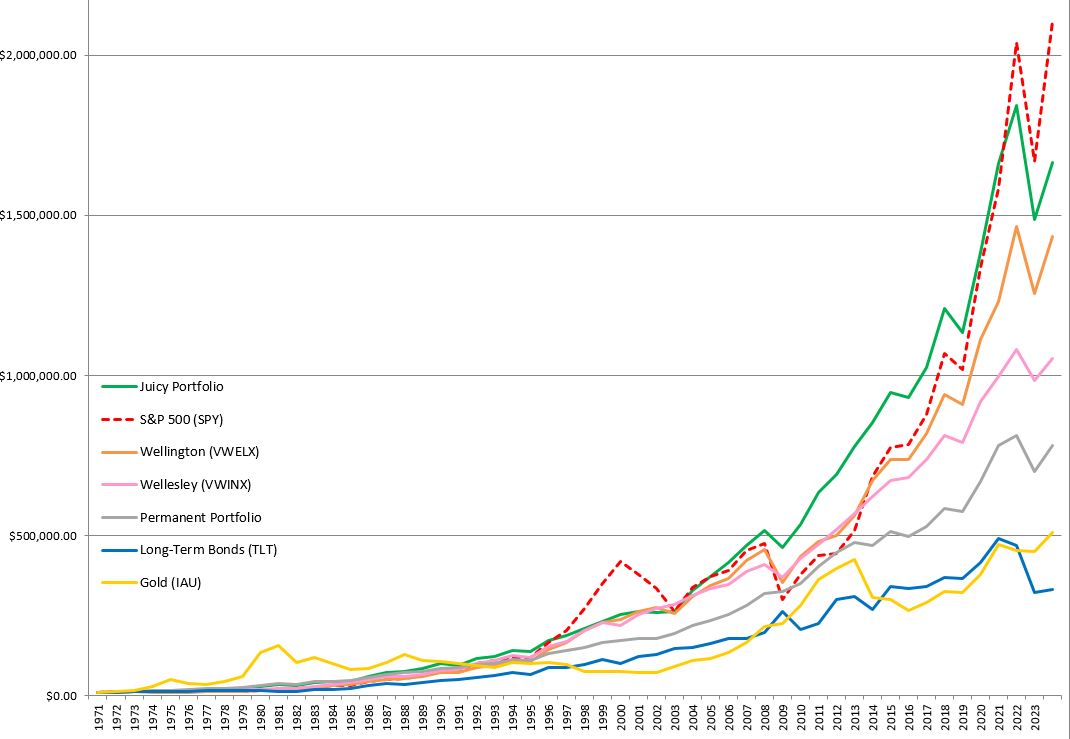

Performance

Starting from 1971 it has returned a ~10% Compound Annual Growth Rate (Annualized Return). A solid track record of strong growth with low volatility. The spreadsheet data below shows how each asset performed yearly, going back to 1971

when the US went off the Gold

Standard.

| 10% | 15% | 15% | 10% | 15% | 10% | 10% | 15% | 100.00% | starting balance | |

| Year | Momentum (MTUM) | LT TIPS (LTPZ) | Gold (IAU) | International (SCZ) | LT Treasuries (TLT) | Small-Cap (IJR) | Mid-Cap (IJH) | Total Stock (VTI) | Yearly Returns % | $10,000.00 |

| 1971 | 14.65 | 29.59 | 9.79 | 15.81 | 14.31 | 14.31 | 14.68 | $11,468.30 | ||

| 1972 | 49.02 | 36.35 | 5.43 | 14.14 | 8.02 | 18.78 | 19.53 | $13,707.83 | ||

| 1973 | 72.96 | -14.92 | -1.36 | -14.96 | -24.20 | -14.66 | 1.46 | $13,908.38 | ||

| 1974 | 66.15 | -23.16 | 4.13 | -10.39 | -26.34 | -26.47 | -1.45 | $13,707.40 | ||

| 1975 | -24.80 | 35.39 | 8.92 | 26.16 | 48.69 | 37.20 | 19.28 | $16,350.19 | ||

| 1976 | -4.10 | 2.54 | 16.50 | 21.62 | 36.67 | 23.84 | 16.38 | $19,028.02 | ||

| 1977 | 22.64 | 18.06 | -0.96 | 6.51 | 1.30 | -7.84 | 3.74 | $19,738.72 | ||

| 1978 | 37.01 | 32.62 | -1.46 | 6.83 | 8.97 | 5.87 | 11.42 | $21,993.47 | ||

| 1979 | 126.55 | 4.75 | -1.46 | 34.39 | 31.48 | 18.05 | 30.12 | $28,617.68 | ||

| 1980 | 15.19 | 22.58 | -4.25 | 44.01 | 30.76 | 31.92 | 18.72 | $33,974.48 | ||

| 1981 | -32.60 | -2.28 | 1.64 | -2.83 | 4.10 | -5.21 | -5.80 | $32,003.45 | ||

| 1982 | 14.94 | -1.86 | 40.04 | 46.42 | 25.21 | 20.97 | 26.47 | $40,475.57 | ||

| 1983 | -16.31 | 23.69 | 0.44 | 18.15 | 27.11 | 21.29 | 9.90 | $44,483.86 | ||

| 1984 | -19.38 | 7.38 | 15.20 | -25.17 | -1.74 | 6.21 | 1.25 | $45,041.02 | ||

| 1985 | 6.00 | 56.16 | 30.66 | 23.07 | 32.79 | 31.23 | 29.11 | $58,151.34 | ||

| 1986 | 18.96 | 69.44 | 24.18 | 0.20 | 17.12 | 18.06 | 23.29 | $71,694.20 | ||

| 1987 | 24.53 | 24.63 | -2.92 | -6.99 | 0.84 | 4.71 | 5.83 | $75,873.26 | ||

| 1988 | -15.26 | 28.27 | 9.15 | 24.63 | 19.44 | 16.22 | 11.75 | $84,784.57 | ||

| 1989 | -2.84 | 10.54 | 17.93 | 10.55 | 26.00 | 31.36 | 17.50 | $99,623.57 | ||

| 1990 | -3.11 | -23.45 | 5.78 | -18.13 | -10.73 | -3.32 | -4.79 | $94,848.11 | ||

| 1991 | -8.56 | 12.13 | 17.43 | 45.26 | 40.44 | 30.22 | 21.28 | $115,034.64 | ||

| 1992 | -5.73 | -12.17 | 7.41 | 18.20 | 15.19 | 7.42 | 5.34 | $121,178.06 | ||

| 1993 | 17.68 | 32.56 | 16.79 | 18.70 | 16.20 | 10.62 | 17.09 | $141,887.39 | ||

| 1994 | -2.17 | 7.78 | -7.04 | -0.51 | -1.72 | -0.17 | -1.93 | $139,156.06 | ||

| 1995 | 0.98 | 1.16 | 30.09 | 28.74 | 33.22 | 35.79 | 24.43 | $173,156.76 | ||

| 1996 | -4.59 | 0.95 | -1.26 | 18.12 | 18.97 | 20.96 | 7.98 | $186,970.34 | ||

| 1997 | -21.41 | -22.72 | 13.90 | 24.59 | 25.66 | 30.99 | 11.46 | $208,395.27 | ||

| 1998 | -0.83 | 5.27 | 13.05 | -2.61 | 9.90 | 23.26 | 10.86 | $231,030.12 | ||

| 1999 | 0.85 | 19.04 | -8.66 | 23.13 | 15.32 | 23.81 | 9.23 | $252,356.51 | ||

| 2000 | -5.44 | -3.08 | 19.72 | -2.67 | 18.10 | -10.57 | 3.69 | $261,674.78 | ||

| 2001 | 0.75 | -4.59 | 4.31 | 6.43 | -1.24 | -10.97 | -1.28 | $258,333.19 | ||

| 2002 | 25.57 | 5.79 | 16.67 | -14.31 | -14.21 | -20.47 | 1.45 | $262,068.69 | ||

| 2003 | 19.89 | 66.48 | 1.62 | 38.50 | 35.21 | 30.75 | 25.18 | $328,047.10 | ||

| 2004 | 4.65 | 34.80 | 8.71 | 22.41 | 16.09 | 12.79 | 13.84 | $373,442.26 | ||

| 2005 | 17.76 | 23.23 | 8.61 | 7.53 | 12.88 | 6.31 | 11.19 | $415,224.85 | ||

| 2006 | 22.27 | 28.39 | 0.71 | 15.09 | 9.67 | 15.69 | 12.79 | $468,336.26 | ||

| 2007 | 30.36 | 2.95 | 10.29 | -0.47 | 7.30 | 5.37 | 9.96 | $514,989.57 | ||

| 2008 | 5.11 | -48.55 | 33.93 | -31.52 | -36.18 | -36.98 | -9.92 | $463,879.43 | ||

| 2009 | 23.90 | 42.85 | -21.80 | 25.88 | 37.81 | 28.89 | 14.92 | $533,097.20 | ||

| 2010 | 8.67 | 29.46 | 21.50 | 9.05 | 26.60 | 26.72 | 17.42 | 18.91 | $633,927.21 | |

| 2011 | 25.10 | 9.57 | -15.14 | 33.93 | 0.79 | -2.18 | 0.97 | 8.88 | $690,245.30 | |

| 2012 | 11.60 | 6.89 | 21.28 | 2.63 | 16.29 | 17.79 | 16.45 | 12.82 | $778,710.59 | |

| 2013 | -19.21 | -28.25 | 28.60 | -13.37 | 41.32 | 33.46 | 33.45 | 9.58 | $853,279.91 | |

| 2014 | 14.62 | 19.68 | -2.05 | -6.07 | 27.30 | 5.85 | 9.71 | 12.54 | 11.03 | $947,409.49 |

| 2015 | 8.93 | -8.83 | -10.58 | 9.10 | -1.79 | -2.07 | -2.33 | 0.36 | -1.76 | $930,706.66 |

| 2016 | 5.00 | 9.16 | 8.31 | 2.63 | 1.18 | 26.61 | 20.73 | 12.83 | 10.22 | $1,025,815.57 |

| 2017 | 37.50 | 9.06 | 12.91 | 32.73 | 9.18 | 13.15 | 16.26 | 21.21 | 17.82 | $1,208,595.39 |

| 2018 | -1.66 | -7.00 | -1.76 | -17.63 | -1.61 | -8.49 | -11.18 | -5.21 | -6.23 | $1,133,263.64 |

| 2019 | 27.25 | 17.47 | 17.98 | 24.67 | 14.12 | 22.82 | 26.10 | 30.67 | 22.12 | $1,383,941.56 |

| 2020 | 29.85 | 24.87 | 25.03 | 11.69 | 18.15 | 11.28 | 13.58 | 21.03 | 20.00 | $1,660,757.55 |

| 2021 | 13.37 | 6.56 | -4.00 | 10.14 | -4.60 | 26.60 | 24.71 | 25.67 | 11.03 | $1,843,880.98 |

| 2022 | -18.26 | -31.68 | -0.63 | -21.24 | -31.24 | -16.19 | -13.14 | -19.51 | -19.34 | $1,487,237.52 |

| 2023 | 9.16 | 0.79 | 12.84 | 13.01 | 2.77 | 16.07 | 16.42 | 26.05 | 11.86 | $1,663,631.33 |

| CAGR | 10.13 |

Key statistics: 1971-2023

| Annualized Return (CAGR) | 10.13% |

| Best Yearly Gain (1979) | 30.12% |

| Worst Yearly Loss (2022) | -19.34% |

Annualized Returns per decade

| 1970s | 1980s | 1990s | 2000s | 2010s | 2020s | |

| 18.72 | -4.79 | 3.69 | 18.91 | 20.00 | ||

| 14.68 | -5.80 | 21.28 | -1.28 | 8.88 | 11.03 | |

| 19.53 | 26.47 | 5.34 | 1.45 | 12.82 | -19.34 | |

| 1.46 | 9.90 | 17.09 | 25.18 | 9.58 | 11.86 | |

| -1.45 | 1.25 | -1.93 | 13.84 | 11.03 | ||

| 19.28 | 29.11 | 24.43 | 11.19 | -1.76 | ||

| 16.38 | 23.29 | 7.98 | 12.79 | 10.22 | ||

| 3.74 | 5.83 | 11.46 | 9.96 | 17.82 | ||

| 11.42 | 11.75 | 10.86 | -9.92 | -6.22 | ||

| 30.12 | 17.50 | 9.23 | 14.92 | 22.12 | ||

| CAGR | 12.39 | 13.29 | 9.74 | 7.77 | 10.01 | 4.71 |

| 35 years (1989 - 2023) | 30 years (1994 - 2023) | 25 years (1999 - 2023) | 20 years (2004 - 2023) | 15 years (2009 - 2023) | 10 years (2014 - 2023) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

| 5 years (2019 - 2023), 7.95% Annualized Return |

|

The linear graph below shows the growth rate of $10,000 starting in 1971.

Other historical charts

20 year performance of the major asset classes (Stocks, Long-Term Bonds, Gold)

Data Sources

The yearly returns of

the 8 funds were used since their inception. Prior to that, similar mutual fund data

was used to

backtest to 1971. Below are the URLs of all the data sources.

Disclaimer

Do your own research. The information on this website is not intended to

constitute financial advice, and is not a recommendation or solicitation to buy,

sell or hold any security. It's strictly educational and is

not to be construed as any kind of investment advice.

Past performance does not guarantee future results.

-A.D.

Webpage last updated January 3, 2024.

Email:

webmaster@tightwadweb.com